In a year of extremes, wildfires are no exception. According to the National Interagency Coordination Center, this year we have seen 4.97 million acres burning across the United States and a historic 2.2 million in California alone. With more than 4,200 structures damaged or destroyed in California, the estimated damage will be significant. By all accounts, these early season numbers indicate that 2020 will be a record-setting year for wildfire events and damage.

This presents a major problem for the many insurance companies tasked with insuring homes and producing profits in the wake of unprecedented wildfire losses. And insurers have good reason to be concerned. According to a report by the Insurance Information Institute, 4.5 million homes in the U.S. have been identified at high risk of wildfire damage. For insurers, there has never been a greater incentive to find ways to identify and mitigate the risk of massive losses due to wildfire.

But as more development creeps further into risk-prone areas like the Wildland Urban Interface—where wildland meets civilization—actuaries tasked with managing risk are finding it increasingly difficult to estimate the risk of wildfire for insured homes, not to mention the task of finding ways to mitigate losses. In the early years of increasing wildfire intensity, the solution seemed to evade the industry and the agencies.

In Red Lodge, Montana, an innovative answer came when David Torgerson founded Wildfire Defense Systems (WDS) in 2001. In a world where we often look to the government to provide solutions, WDS offers private wildfire suppression services to top insurance companies at a wildfire agency scale. With its own fleet of fire suppression equipment and teams of experienced firefighters, WDS is the market’s response to prevent catastrophic losses of insured properties in the event of a wildfire.

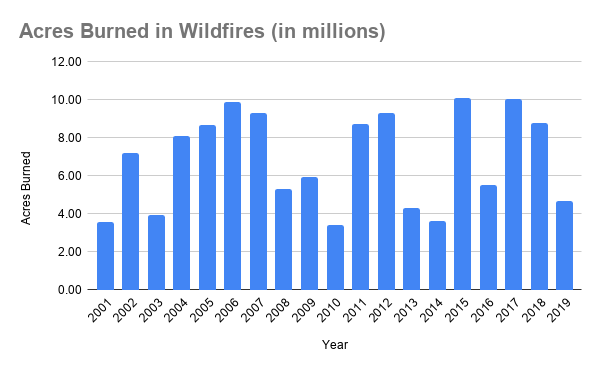

According to the Federation of American Statistics, wildfire intensity has been growing since the early 2000s. The number of acres burned in wildfire events, however, has been extremely variable, creating challenges for insurers tasked with covering losses (see chart below.) In 2015, with a historic 10.13 million acres burned by wildfire, the need for models to better predict a home’s risk level became apparent. Again, WDS answered.

Seeing the variation of burned acreage as an opportunity, in 2013 WDS began the process of creating a model that would better predict the probability a structure would be damaged due to a wildfire event. I had the privilege of being the lead economist on the WDS team that created the model and saw the process firsthand. Using state of the art regression analysis, WDS created a model that takes into account factors such as fuel load, fuel type, fuel alignment, and regional considerations, including topography, climate, and fire history, and produces a risk score for a piece of property. It then compares that score to the region’s average to get a sense of how much the structure is at risk compared to the surrounding region. The finished model, named WDSrisk, is revolutionizing the way insurers think about wildfire risk, and it is making amazing progress in the industry’s approach to analyzing the risk of losses during a wildfire event.

On Saturday, September 5th, this market-based approach to wildfire risk assessment and loss prevention was put to the test. The Bridger Foothills Fire started the day before, approximately 2.5 miles northeast of Bozeman, Montana. Within six hours, the fire had grown to about 400 acres and was dangerously close to homes in the Wildland Urban Interface—homes insured by clients of WDS. As the fire grew to more than 7,100 acres and spread to Bridger Canyon, WDS deployed three fire crews to privately protect homes in conjunction with public response teams.

Nick Lauria, WDS’s COO and head of research and development for the risk model, stated that the model did a great job of predicting risk and directing their forces to maximize results. In other words, the market’s innovative response to the issue of increasing risk from wildfire not only saved homes and costly losses, but it also helped to prevent further spread by adding equipment and manpower to the efforts.

As wildfire response and wildfire suppression engulf more of the USFS’s already strained budget, private solutions can offer quick and decisive answers. From forest resiliency bonds tied to better forest management to private wildfire suppression companies like WDS, innovation will be key to protecting our forests and our homes.