There is a budding bipartisan proposal to increase the federal highway gas tax. A Republican senator from Tennessee, Bob Corker, and a Democratic senator from Connecticut, Chris Murphy, are co-sponsoring a bill to raise the highway gas tax 6 cents per gallon twice over the next two years, a 12-cent total increase.

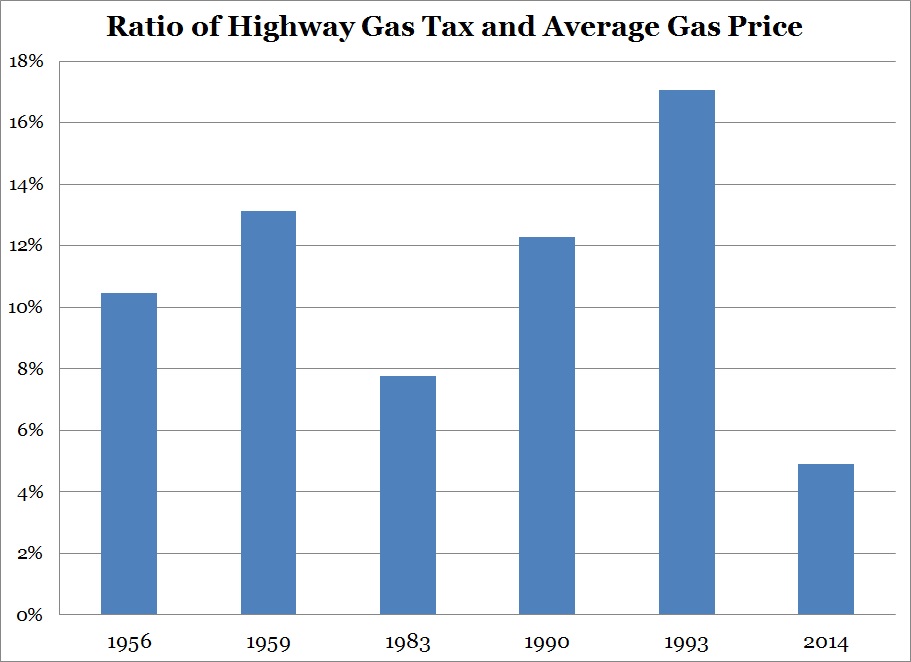

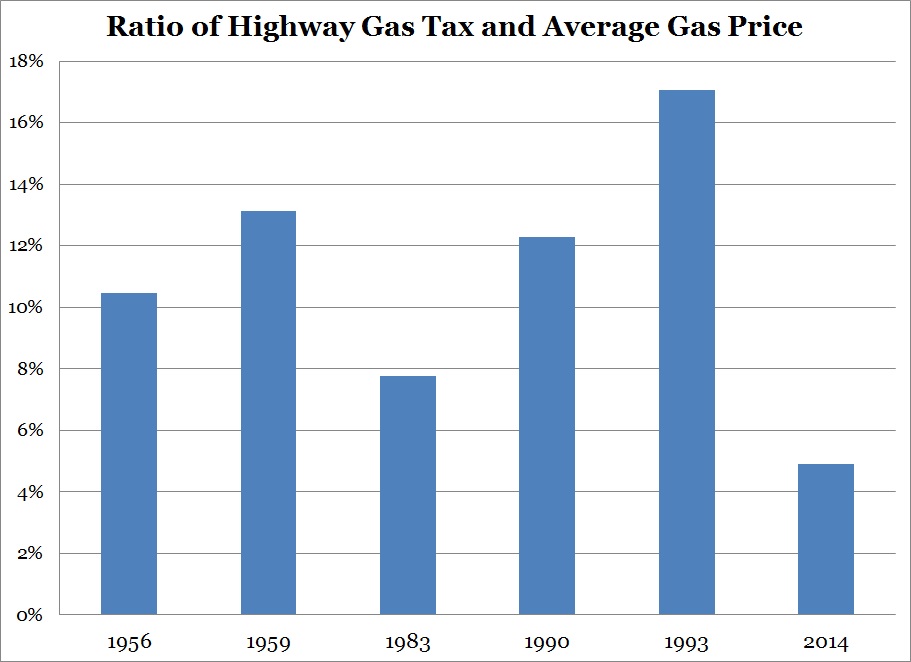

The current federal highway gas tax is 18.4 cents and has been since 1993 (the tax on diesel fuel is 24.4 cents per gallon). These tax revenues, with very important exceptions, flow into an account called the Highway Trust Fund, created in 1956. Prior to that federal subsidies to states for roads and construction came from general revenues. The original tax was 3 cents per gallon. The figure below shows the historical relationship between the federal highway fuel tax and the average price of gasoline.

At its outset the tax was approximately 10 percent of the price of gasoline. It is now about half that amount. The question is begged: What happened to this great tax, the tax that only the user paid, the tax where the revenues went directly to impact only those who paid it, the tax where anybody who wanted could legally and easily avoid the tax by simply walking, biking, or flying? It’s hard to name a better tax than the original highway motor fuel tax.

(As if you needed anymore argument, note also that the tax was not applied to motor fuel users who did not use the roads. Farmers, heavy equipment operators, and anyone else using gas or diesel in an “off-road” application did not have to pay the tax. It’s almost a miracle that such a tax ever got passed and lasted so long whole.)

Will the gasoline tax increase pass? Maybe. There is a huge hue and cry for additional infrastructure in our country, and anybody who has recently tried to drive in Los Angeles, Atlanta, or Miami surely knows that there isn’t much room for all the cars and trucks trying, even the hybrids and electric ones. And, indeed some of the highway tax money might actually end up building new roads and bridges, or repairing ailing ones. The fly in the ointment is the some might.

In 1990, Republican George H.W. Bush signed a bill ending the direct link between the gas tax and highway improvements. That law allocated 2.5 cents of the new tax (from 9.1 to 14.1 cents) to “deficit reduction.” And the user tax had been converted to general revenues, taken from those with and given to those with need. This movement away from a user fee to lack of accountability advanced soon after when Clinton signed an increase from 14.1 cents to the current 18.4 cents with all of the increase going to a common pool of general revenues. Subsequently, Mr. Clinton signed the so-called Taxpayer Relief Act, which reconverted all of that increase back to highways.

The highway gas tax is no longer just a highway gas tax but is now also a general revenue sales tax. Over half of the tax still goes to highways, but the rest is lost in the vortex of the general tax feeding pool for any interest group to seek and any politician to oblige. Having lived two-thirds of a century and watched House of Cards, I am certain that I have no capacity to predict politics, but if this gas tax does not pass, and our highways, bridges, and roads continue their decline to third-world status, you can blame the tragedy on the shift of the highway tax from a user fee to general revenue tax. This commenced 25 (or 30) years ago with a Republican president and augmented soon after by a Democratic one.

To some this is sad. There is no party to blame. Instead, history suggests that the inevitable happened. Something good, transparent, simple and powerful got wooed away. There is nobody to blame. The fault lies with process, our constitution, and the never ending desires of people to have other people pay for their stuff. Who can rationally blame the driving public for fighting an increase in the cost of driving when a big chunk of the revenues might or probably will go who knows where for what purpose or cause? Transparency has been lost and a great tax became a good one became, along the way, just another tax.

Economists rarely agree on anything, and in general that is good. Healthy debate is valuable. However, my 40-year exploration in public finance theory and evidence suggests that there is an overpowering consensus that direct user fees, such as the original highway gas tax and PERC supported user fees for national and state parks, coral reefs, and many other public arenas, are the best kind of taxation. First, only the people who use the service pay for it. Second, it is avoidable by simply not using the asset in question. Third, people pay for the use of the asset in direct proportion to their use of it (the more your drive the more you pay), and fourth, the tax is basically free of the huge costs of rent seeking (of course, until it isn’t, see 1990).

User fees may not be perfect. There are nuances and issues that a thousand or more economists could explain to you if you can find room on the head of their pin. But in its simplest form, a user fee charges only those who use a public service, and if designed with just a little thought and care, in direct proportion to their use. The revenues cover costs, the taxing is transparent, the payers and users can determine with comparative ease whether they like the tax or want more or less of it. The highway motor fuel tax stood tall for 30 odd years. And, a big chunk of it still has those features.

Will we see an increase coming out of the congress any time soon? Will the 18.4 cents rise to 24.4 and then 30.4 cents? Perhaps the forthcoming season of House of Cards will give us the answer.

One thing is certain: The bill is far more likely to be popular with motorists if the increase is earmarked and dedicated for highways and bridges instead of general tax receipts or, God forbid, “deficit reduction.” Or maybe, just maybe, states will build their own roads instead of using the monopoly power of the federal government to prevent competition in the financing and building of roads. I do not hold much hope for the latter. The lucre is too sweet.

And, oh yeah, by the way, go Tigers.