By Andrew P. Morriss

If we substitute “the federal government” or “the United Nations Environment Programme” or “the European Union” for “you” and change the email to a proposed law, however, we discover that politicians from Washington to Brussels are embracing measures to “green” the economy and create “green jobs” with an almost religious fervor, despite weak empirical support for these proposals. The Obama administration included billions of spending and tax incentives for green initiatives in its budget, and last spring’s “stimulus” bill poured $62 billion in transfers plus $20 billion in tax cuts into “green initiatives.”

Unfortunately, the rhetoric about “greening the economy” or creating “green jobs” is just political window-dressing for some of the same central-planning measures proposed by the left for years. Behind that rhetoric are proposals built around government subsidies for favored technologies, measures to limit trade, and a great deal of wishful thinking about alternative energy measures not quite ready for prime time.

What Counts as Green?

The first problem in untangling the claims made by green-economy proponents is determining what counts as a “green” job or technology. Many times no definition at all is provided; even when the term is defined, different groups pick quite different definitions. For example, the U.S. Conference of Mayors’ reportCurrent and Potential Green Jobs in the U.S. Economy defines a green job as

any activity that generates electricity using renewable or nuclear fuels, agriculture jobs supplying corn or soy for transportation fuels, manufacturing jobs producing goods used in renewable power generation, equipment dealers and wholesalers specializing in renewable energy or energy-efficiency products, construction and installation of energy and pollution management systems, government administration of environmental programs, and supporting jobs in the engineering, legal, research and consulting fields.

Interestingly, the mayors count jobs in existing nuclear power plants but not in new ones.

In contrast the United Nations Environment Programme’s Green Jobs: Towards Decent Work in a Sustainable, Low-Carbon World excludes all nuclear jobs, but includes all jobs said to “contribute substantially to preserving or restoring environmental quality.”

If we take politics into account we can explain these definitions. The Conference of Mayors is concerned with building a coalition for spending to benefit its members. Those mayors with nuclear power plants in their cities want to claim credit for greening their economy through nuclear plants (which also pay lots of local taxes). The U.N. report, on the other hand, was aimed at gaining support from an international environmental movement that detests nuclear power, which explains why it didn’t count any nuclear jobs.

Neither applies any objective criteria to the problem of defining which industries will gain and which will lose. For example, both define as “green” any jobs related to nonfossil-fuel technology, even if these energy sources (such as wood) release as much carbon dioxide per BTU of energy generated as fossil-fuel sources—or more. (Wood is much less efficient in terms of carbon emissions than either natural gas or gasoline on a per-BTU basis.) Moreover, burning many renewable fuels produces considerable particulate pollution, both inside homes and outside—a serious problem particularly for women and children in developing countries.

Green-economy proponents also disagree about how green hydroelectric plants are. Many who advocate government spending on alternative energy also want to dismantle existing hydro projects to restore rivers and improve fish habitats. (And many of those dams were built with subsidies by the Bureau of Reclamation and Army Corps of Engineers and would have flunked any serious cost-benefit analysis.) But small hydro, their preferred alternative, is by definition “small.” As a result, it would take quite a few small hydro plants to produce sufficient energy to replace even a single large dam or coal-fired power plant. Not surprisingly, there is no evidence of a large-scale building boom in small hydro projects or even a serious effort to identify where such projects might be located.

Even more interestingly, both definitions are expansive enough to include “supporting jobs in the engineering, legal, research, and consulting fields.” Indeed, the Conference of Mayors found that the top two U.S. jurisdictions for current green jobs are New York City and Washington, D.C., suggesting that the investment in green technology so far is producing a lot of consultants, lawyers, and lobbyists rather than engineers or factory workers. Another estimate found more secretaries, management analysts, bookkeepers, and janitors among “green jobs” than environmental scientists.

Defining terms is essential to a rational policy debate; without clarity we end up with a division between favored and disfavored technologies driven by interest groups rather than by either market forces or logical thinking. Unfortunately, so far the green-economy literature has mostly produced lists of “technologies we like” and “technologies we don’t like” based on politics. We certainly shouldn’t be spending billions of dollars promoting what we can’t define.

Where Do Estimates Come From?

Even if we don’t quite know what a green economy looks like, its advocates assure us there will be lots of jobs and other benefits from converting to it. Not surprisingly, most green-economy proposals predict huge benefits at low cost, making them politically appealing. Jobs will appear in economically depressed areas, and energy efficiency will soar, saving firms, consumers, and governments billions. Unfortunately these benefits are largely due to inappropriate economic forecasting methods. In particular, most estimates are produced via “input-output analysis,” the same technique used to produce outlandish claims for the benefits of municipal stadium projects.

In an input-output analysis a vast matrix is calculated from economic data as they exist today, tracing connections between firms in different industries. For example, an automobile plant uses steel, aluminum, plastic, batteries, paint, tires, and other materials to produce cars with a particular amount of labor per car under current technology. If we thought that the plant would begin producing more cars, the input-output matrix could be used to calculate how much more steel, aluminum, and other inputs would be demanded by the car industry and how many more workers would be hired to work in it.

There is a role for such calculations in industry forecasts (predicting steel demand from auto production helps steel plants decide about investing in new capacity, for example). But using them to predict the impact of government programs to green the economy is problematic because the method rests on two assumptions that green proposals violate: constant prices and constant technology.

By definition, efforts to change energy technology are going to change technology and prices. The relationships in an input-output matrix based on using coal to generate electricity and gasoline to fuel cars simply aren’t applicable to an economy where substantial amounts of energy come from high-cost sources like wind and solar and the cars are hybrids or run on ethanol.

Worse, the green-economy predictions rest on extremely optimistic estimates of the impact of spending on new technologies. Almost no advocates of these policies deduct the jobs lost from replacing existing technologies with the new, green ones. Refinery workers, coal miners, fossil-fuel power plant workers, and many others will all lose their jobs if the proposed shift to nonfossil fuels takes place. Some of those workers may find jobs insulating public buildings or bolting together windmills, but many will not. Because all that public spending to produce these new technologies comes from taxes (whether today or in the future), it reduces private spending and so eliminates the jobs that would have been created by the higher private spending displaced by the taxes.

Any estimates of major changes are likely to be imprecise even if all these factors are taken into account because of the considerable uncertainty surrounding these relationships. Ignoring all the downsides, as green-economy proponents do, suggests that they are less interested in accurate predictions than in creating political pressure for policies regardless of their impact.

Labor Productivity

Even if we set aside these technical issues, however, there are still some serious problems with green-economy plans. Perhaps most important, the literature mistakenly glorifies low-productivity jobs on grounds that more employment is better. For example, the UN Environment Programme criticizes modern agriculture because “labor is extruded from all points in the system,” argues wind and solar are better technologies because producing each BTU of energy requires more labor than in fossil-fuel industries, and argues that the steel industry has evolved to use too little labor.

To see why this is a problem, let’s consider ethanol. Although even many environmentalists now recognize ethanol’s problems, it was the darling of alternative-energy proponents for many years, and hundreds of millions of dollars in subsidies have produced a substantial corn-based ethanol industry in the United States. (Despite these subsidies, the fuel remains uncompetitive with gasoline at current gas prices.) Corn-based ethanol requires more labor to produce than gasoline does, largely because growing and processing corn is more labor-intensive than pumping and refining oil. As a result, green-economy advocates score ethanol higher than gasoline since each BTU of energy in ethanol takes more labor to make than a BTU of gasoline.

But lower labor productivity is a bad thing not a benefit. Not only does more labor mean higher costs, but higher-productivity jobs (generally those that involve working with greater amounts of capital) can pay higher wages precisely because they are more productive. Low-productivity jobs are low-paying jobs because employers cannot afford to pay their employees more than the employees generate. If more labor were the metric, we’d all be better off using quills and parchment in place of computers.

Rejecting Trade

The advocates for greening the economy reject more than basic labor economics. They also believe that a green economy is one with relatively little trade. The literature emphasizes buying locally produced goods over those from other areas, both to save the transportation costs and to promote self-sufficiency. Not surprisingly, the UN Environment Programme criticizes Walmart for its global supply chain:

Companies like Wal-Mart (with its policy of global sourcing and especially its policy of searching for cheap products, with potential negative impacts for labor and the environment) are major drivers and symptoms of [increased global trade]. . . . Ultimately a more sustainable economic system will have to be based on shorter distances and thus reduced transportation needs. This is not so much a technical challenge as a fundamental systemic challenge.

To be fair, the benefits of trade are sometimes hard to understand. Nobel Prize-winner Paul Samuelson said the theory of comparative advantage was a contribution of economic theory that was both “nonobvious and nontrivial,” and generations of Econ 101 instructors have proved his point by struggling to get students to understand it. But the libertarian case for trade is remarkably simple and clear: Voluntary exchanges must make people better off or they wouldn’t occur, so a world with more voluntary exchange is preferable to one with less. Even the person most confused by trade theory can understand that autarky (producing everything locally) is a recipe for disaster by examining the record of Albania under communist dictator Enver Hoxha or North Korea today, two examples of societies where the rulers reject virtually all trade.

Moreover, the idea of locally grown food (a key component of the green economy) is hard to accept for those of us living far enough north to lack a year-round growing season. From my home in rural Illinois, I can see miles of soybean and corn fields. I am delighted that my neighbors can trade their corn and soybeans to people living elsewhere and that people in countries from France to Honduras to Israel to New Zealand send agricultural products here in return. I can buy French wine, Honduran bananas, Israeli citrus, and New Zealand lamb in my local grocery store because of trade, enriching both the variety and healthfulness of my diet. Even if it didn’t make us better off, the freedom to trade would be an important liberty. Since it does, it is indispensable to the vastly better lives we live today compared to our ancestors.

Ignoring Incentives

Those advocating for a green economy often appear to believe that no one will undertake any measures to improve environmental quality or conserve resources without a government program to show them the way. We know this is false because we have over a hundred years of experience with market incentives for both providing environmental quality and reducing resource use.

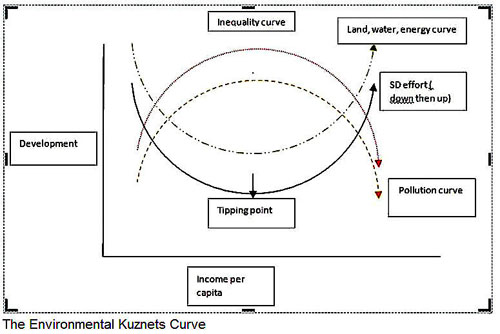

Studies of income levels and environmental quality have found what is termed the “environmental Kuznets curve,” a U-shaped relationship between national income and environmental quality. As very poor countries begin to develop, environmental quality often falls as energy production and use increase, factories appear, and people begin to consume more. But once per capita gross domestic product (GDP) reaches about $5,000, people can afford to spend more on improving the environment. Not surprisingly they do, and environmental quality improves after that point with respect to most pollutants for which we have data. In short, richer is greener.

Environmental quality also improves because market incentives spur firms to reduce energy and resource use. Any firm that cuts its energy use can devote the savings to undercutting its competitors’ prices. This has happened on an economy-wide basis. For example, from the 1970s to 2000, energy use per dollar of real GDP fell by 36 percent as firms economized on energy without reducing output.

Each unit of energy input yielded four times as much useful heat, moved people 550 times farther, provided 50 times more illumination, and produced 12 times as much electricity in 2000 compared to 1900—a stunning success story. Major energy-using industries like steel, aluminum, and paper have all become more energy- and resource-efficient, while consumer goods like refrigerators have become larger, more feature-rich, and cheaper to operate. It doesn’t take a government program to make firms more efficient, but it does take a market economy.

According to its proponents, the green economy will run on biofuels, wind, and solar power, ushering in a new age of clean energy. Unfortunately, this is mostly wishful thinking. The Department of Energy (DOE) says wind currently contributes less than 0.6 percent of total U.S. energy production. (Usually green-energy advocates note that it contributes 7 percent of renewable electricity generation, ignoring the less flattering total energy numbers.) Moreover, wind is both expensive and unreliable, as wind turbines produce energy only when the wind blows. Plus the massive wind farms green-energy advocates envision would require building what DOE estimates are $60 billion of new transmission lines (which many environmentalists oppose) and offshore wind farms like the Cape Wind project (blocked for years by the late Sen. Ted Kennedy, who objected to its impact on the view from his sailboat). There are also important questions about wind turbines’ effects on bird populations and the impact of “shadow flicker” from the turbine blades on neighbors. Similarly, solar power (mostly solar thermal and hot-water production) currently produces only 0.05 percent of U.S. energy consumption and is projected by DOE to rise to just 0.13 percent by 2030. Solar panel arrays take a great deal of land, usually in sensitive desert environments where endangered-species issues have already blocked some proposed photovoltaic sites. And both solar and wind power require expensive backup plants for when weather conditions aren’t right (such as at night and on days without wind).

None of these problems are insurmountable, and it is quite possible (and perhaps likely) that as the prices of natural gas and oil rise in the future, an entrepreneurial inventor will find ways to make these technologies viable. The problem is that they are not viable today and will not become so in an environment of subsidies

ANDREW P. MORRISS is D. Paul Jones, Jr., Chair in Law at the University of Alabama and a Senior Fellow at the Property and Environment Research Center.