The revitalization of the oil and natural gas sector in the United States can be attributed to a fortunate combination of technological innovation and private property rights. The technological innovation has many parts, but hydraulic fracturing, or “fracking,” is often singled out as a key component. Although fracking has been used since the late 1940s, its recent application with directional and horizontal drilling is helping unlock massive amounts of oil and gas, most of which were previously out of reach.

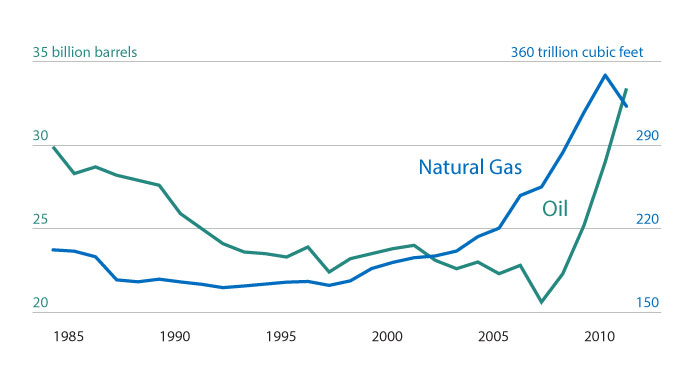

The results are remarkable. From 2007 to 2012, U.S. economic reserves of crude oil increased by 43 percent. During that same period, natural gas reserves grew by more than 30 percent. While the price of oil is closely tied to global oil markets, these increases triggered a sharp decline in the price of natural gas in the United States. Spot prices for natural gas have averaged $3.87 since the beginning of 2009, versus $7.46 for the five years prior. The technical revolution has given rise to an economic one.

At its most basic level, fracking facilitates the production of oil and natural gas from rocks that otherwise would not have enough permeability. Shale is one example of such a rock. The fracking process used today is a distillation of advances made over several decades to access the oil and gas within shale and other “unconventional” reservoirs. Although fracking is often mischaracterized as a drilling technology, the fracking process does not begin until after the wellbore is drilled. Fracking has increased drilling, however, because many wells would not be drilled at all if they could not be fractured.

A non-technical description of hydraulic fracturing helps explain the source of the recent productivity gains. The basic idea is to inject fluid into the target formation at sufficient pressure to crack the rocks. Pressure is generated by large pumps on the surface. The solvent conveys the pressure and is also used to carry material known as proppant (usually sand) down into the fractures that are created. The sand props the fractures open after the pressure is released. In some reservoirs, sand may not be strong enough to hold the fractures open, and more durable synthetic proppants can be used instead. Once propped open, the fracture allows oil and gas that would otherwise be trapped in the rock to flow to the wellbore and then to the surface.

The fluids injected during the fracking process have generated considerable controversy. While water and proppant are the main ingredients, other additives are usually included to improve the performance of the well. These additives sometimes include toxic chemicals, albeit in dilute solution. More controversially, some oil and gas companies do not want to divulge the exact ingredients in their fluids, deeming the recipes to be trade secrets. Many states have maintained trade secret provisions, but key producing states including Colorado and Texas are moving towards full disclosure.

Remarkable as it is, fracking usually needs to be used with directional and horizontal drilling to make shale and other lower-grade resources economically viable. Directional drilling allows the well to follow thin seams of shale, giving a single well access to a larger volume of oil and gas. Advanced seismography and other related technologies are also important in triggering the boom.

THE UNITED STATES IS UNIQUE in that private citizens own a majority of the mineral property. In most other countries, the government retains ownership and control of mineral development. But in the United States, private rights to mineral property evolved to solve disputes over mining, especially on the western frontier.

Property rights to oil and gas follow the rule of capture. The rule of capture means that property rights to oil and gas resources are established by bringing them to the surface. The rule often creates an incentive to extract oil and gas more quickly than geophysics dictates is optimal. As a result, a variety of regulatory and contractual solutions were created to address the problems associated with common pool resources such as oil and gas. Regulatory examples include restrictions on the amount of space between wells. Contractual solutions include unitization and communitization agreements, which are contracts between competitors that help to reduce resource waste. Such contractual agreements are widely used, although in some cases parties have weak incentives to enter into the contracts voluntarily.

Oil and gas companies usually obtain access to resources by leasing rather than purchasing mineral rights. Historically, leasing allowed companies to sink a vertical well to access the underlying oil and gas through the rule of capture. The rights of neighboring mineral owners were protected by state regulations on offsets and well spacing.

Directional drilling introduces a new set of property rights questions. A directional well could, in theory, infringe on neighboring mineral rights by crossing a property line—even thousands of feet underground. However, when oil and gas wells are permitted by state oil and gas commissions, proof of lease is required for all minerals accessed. Such permit requirements help drillers avoid trespass with the drill bit.

The fracking process itself creates new property rights issues to consider. Because fractures are necessary to crack the rocks and release the oil and gas, the chance of trespass seems endemic. A fracture could easily extend across a property line and access neighboring resources. And although unconventional reservoirs are less permeable than conventional reservoirs, the oil and gas resources are still fugitive once they are accessed by fractures. Microseismic surveys help engineers and geologists understand how fractures are created, but this information is typically used to improve frac design rather than resolve trespass disputes. Because the interpretation of microseismic data is not indisputable, courts have so far opted to continue applying the rule of capture for fracking, citing a 2010 Texas Supreme Court decision.

PAVILLION, WYOMING, makes an unlikely setting for the front line of the fracking wars. Sitting in a high arid basin in central Wyoming, the town boasts fewer than 250 residents, and not many more in the neighboring ranchlands. An area just northeast of the town has been the epicenter of debate over whether hydraulic fracturing contaminates groundwater.

Residents of Pavillion are familiar with the oil and gas industry in the state and in their own community. Oil and gas development has affected the surrounding area for decades, with the earliest wells drilled in 1960. This makes complaints about damages from fracking easier to distinguish from complaints about development in general and helps isolate fracking as the proximate cause.

Unlike other fracking hotspots such as Colorado or northeastern Pennsylvania, Pavillion is well off the tourist track. It boasts few, if any, second homeowners. Yet concerns about fracking-induced changes to water quality in Pavillion are shared by long-time residents and ranchers alike. These concerns came to a head in 2008, several years after the first wells were fractured.

A total of 125 wells are located on the nine square miles of greatest concern. While some of these wells were drilled in earlier decades, a large number were drilled in the early 2000s and completed with fracturing treatments to access the tight sands of the Wind River and Fort Union formations. Development of the new wells preceded complaints by residents of degraded well water quality. Well users reported objectionable tastes and odors that had not been present in older wells.

After two years of tests by the oil and gas company operating the wells did not satisfy the residents, the Environmental Protection Agency launched an investigation into the reported groundwater contamination. The agency drilled two monitoring wells to test groundwater quality for contamination.

In many ways, the Pavillion case provides a litmus test for understanding the local environmental effects of fracking. The bulk of the fracturing jobs were done relatively early, before engineering safeguards for groundwater became common. Technical understanding and control of fracking operations has increased over time, so these earlier jobs may have been less precise. The open-hole completions used in many of the wells have the lowest degree of control over fracture propagation.

The fracturing in Pavillion also took place at a relatively shallow depth—as shallow as 1,220 feet below the surface. The groundwater is relatively deep in the area, with water wells reaching as far as 800 feet below the surface. This leaves an unusually narrow distance between the bottom of water wells and the shallowest fractures. By contrast, in many other cases, thousands of feet of rock separate the fractured region from the groundwater. Some of the gas wells in Pavillion also have shallow production casing, in some cases only 361 feet below the surface. Although shallow production casing is distant from the deep groundwater wells, the possibility that there are relatively small separations between water resources and fractured wells is evident.

The EPA did four rounds of testing between March 2009 and April 2011, including two deep monitoring wells and shallower wells near evaporation pits and existing water wells for stock, domestic, and municipal use. A draft report was filed by the EPA in late 2011 indicating that chemicals from fracking fluids were found in groundwater.

This was the “smoking gun” that many environmentalists had been waiting for, and several groups wasted no time in advertising the draft findings. Meanwhile, industry groups, including the operator of the wells, responded fiercely to the allegations of contamination.

The ensuing public debate led the U.S. Geological Survey to investigate the EPA’s groundwater samples. In September 2012, the USGS released its own report that discredited the central results regarding fracking fluid contamination in the EPA’s draft report. The EPA has since backed off its earlier conclusions and has elected not to issue a final report. The debate over groundwater contamination due to fracking, however, continues today in Pavillion and elsewhere.

REGULATION OF FRACKING has been mooted, particularly in response to concerns over potential environmental impacts. As the events in Pavillion demonstrate, definitive evidence of damages due to fracking—and not the result of other impacts associated with development—has been elusive. The benefits are relatively easy to observe in the form of increased reserves, higher production, and lower energy prices.

The fracking process is constantly being refined and improved. The environmental risks associated with fracking are still being studied, and progress is being made to address such risks with better management practices. Continuing work to identify and quantify negative impacts will aid future regulators.

Energy markets are still adapting to the new possibilities unleashed by hydraulic fracturing. Unconventional resources have revitalized the oil and gas supply in the United States, and they are now having an impact on global markets. Close attention to the relevant property rights—already identified as a key cause of the “shale revolution”—will improve the long-term prospects for oil and gas development in the United States.

Read more: “Frackonomics: Some Economics of Hydraulic Fracturing,” by Tim Fitzgerald. Case Western Reserve Law Review, Vol. 63, No. 4 (Summer 2013).